Applications for our Personal Credit Card are currently closed.

Important things to consider before applying for credit

Before you apply for credit, it’s important to know if you’re eligible. Applying when you’re not, can harm your credit score and reduce your chances of getting credit in the future.

You can check your eligibility for a Cashplus overdraft without affecting your credit score.

You should also carefully consider the type of credit you’re applying for to make sure it best suits your needs.

Get to know your credit score

A credit score is a prediction of how likely you are to pay back any money you borrow using a credit product like a credit card, personal loan or mortgage.

In the UK there are three main credit reference agencies (CRAs) that collect information about you from public records, lenders and service providers. Using this information, each creates a credit score that represents how much you could borrow and your ability to pay it back, based on the data it holds.

Your credit score will change over time in line with your circumstances, and each CRA’s credit score for you may be slightly different. The higher your credit score, the more likely you are to be accepted when applying for credit.

Lenders will use your credit score alongside other information like your past account history, the amount of credit you already have open, your income and your regular outgoings, to decide whether you’re eligible for credit. So, managing your finances carefully can make a big difference on your likelihood of being approved.

You have options if you’ve been denied credit

Being refused a credit card or overdraft can be disappointing, but there are steps you can take to find out why and improve your credit rating.

Been refused credit?

There are several reasons why you may have been refused credit. Lenders can tell you which credit reference agency they used, so you can approach them directly to see your credit file.

Common reasons you may have been refused credit include:

- you’re ineligible based on the personal information you provided

- your credit score is too low

- you have a poor credit history based on how you managed previous accounts

- you’ve applied for more credit than the lender thinks you’ll be able to repay

- something in your credit file suggests fraudulent activity

- the lender’s lending criteria disqualifies you – for example setting a minimum income to qualify for credit

Improve your credit rating

The first thing you should do is check your credit record with at least one of the credit reference agencies to make sure the information they have about you is correct. You have the right to get one free copy of your credit report each year.

If you see something that’s not right, you can contact the credit reference agency, tell them what’s wrong (preferably with supporting evidence) and ask them to update their files. Once you’re sure all the information they hold about you is correct, you can take the next steps towards improving your rating.

- Reduce existing debts. Reducing your outstanding credit and the amount you have to pay in interest and repayments reduces your credit risk to lenders.

- Consolidate your credit. Closing any accounts you don’t use and consolidating your debts into one can reduce your repayments and improve your credit rating.

- Manage your accounts properly. Meeting all your financial commitments on time and staying within your agreed credit limits shows you are financially responsible and will improve your credit score over time.

- Register to vote. If you’re not already, registering on the electoral roll helps lenders and credit reference agencies confirm your personal information, which improves your credit score.

Spend at least six months working on improving your credit score before you apply again.

To get more advice on what to do if you’ve been refused credit, go to MoneyHelper

Our Creditbuilder could improve your credit score

We offer credit products for both individuals and businesses that could help improve your credit score as long as you use them properly.

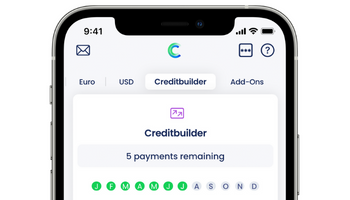

Creditbuilder

Creditbuilder is an Activeplus bank account add-on that’s exclusive to Cashplus. If you’re new to the UK, don’t have much credit history or want to improve your credit score, Creditbuilder can help steer you in the right direction.

Business Creditbuilder

Cashplus Bank Business Extra account holders can take advantage of our Business Creditbuilder. If you’re a new business or have missed a payment or two in the past, you could use it to give your company credit score a boost.

It’s important to remember that you’ll only improve your credit rating if you make all your Creditbuilder repayments on time. Paying late or missing a payment could harm your credit rating, as we’re obliged to report negative as well as positive information to the credit reference agencies. Harming your credit rating could make it harder to get credit in the future. It could also result in legal action against you to recover any overdue payments.

Terms and Conditions apply, including applicants being resident in the UK & aged 18+ and, if relevant, businesses being based in the UK.

For full website terms including information on Zempler Bank, Mastercard and use of trademarks, please see our full legal disclosures at https://www.zemplerbank.com/legal/. Zempler Bank Limited (“Zempler Bank”) is registered in England and Wales at Cottons Centre, Cottons Lane, London SE1 2QG (No.04947027). Zempler Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under Firm Reference Number 671140.

Zempler Bank provides credit facilities subject to approval and affordability, and where accounts continue to meet Zempler Bank credit criteria.