Fast Account Number and Sort Code

We know how important it is to be able to start taking payments as a business, so we’ll provide your new account details straight away, online.

Business Mastercard

Your contactless business Mastercard will be with you in 3-5 business days once approved, personalised with your business’ name.

Payments and Transfers

Send faster payments from your business bank account from the Cashplus banking app or Online banking. Pay bills, suppliers and employees easily.

Centralised Account Management System

Manage any additional employee and business expense cards or travel cards centrally, via one online system. Track spend, move money, add or block cards and restrict transactions.

Banking app and Online banking

Manage your account 24/7 from any device. Get real time balance information, statements, add payees, send payments, apply for extras and download statements whenever you need them.

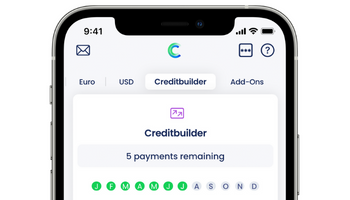

Business Creditbuilder

If you have one of our Business Extra accounts, you could improve your business credit score with Business Creditbuilder. The Business Bank Account add-on unique to Cashplus.

Download statements

Improve your tax reporting, record keeping and audit trails via downloadable statements in CSV or OFX, straight from your online account.

Spending Insights

Track and tag your payments with the help of Google Maps data. You can create a tag and assign any transaction to a certain project and attach receipts and notes to individual transactions.

The Cashplus API

Integrate our bank accounts with new and existing applications. We’re working on opening access to our services even more.

Post Office Branch Services

Our association with the Post Office means you can deposit cash into your account at any UK branch. The money will be available instantly.

Straightforward Pricing

Choose between our Business Go or Business Extra pricing depending on what suits your business best. For a full pricing breakdown, see our Business account pricing page.

Business Cash Advance

We want your business to succeed and we know that poor cash flow can be one of the biggest problems for new and small businesses. We’ve designed our up to £15,000 cash advance to help with just that.

UK based Customer Services Team

Get account information, report your card lost or stolen, rely on 24-hour fraud monitoring for your security, or speak to one of our friendly team in the north!

Business Expense Cards

Add up to 20 additional cards to your business bank account to provide to your employees, for simpler expense management.

Fraud Monitoring

We’ll keep your account activity in check with 24 hour fraud monitoring for your security.

FSCS protection

Get added peace of mind knowing your money is protected up to £85,000 by the FSCS (Financial Services Compensation Scheme).

Pots

Set aside money for unexpected expenses, taxes, to do lists, and business goals. Your pot sits alongside your main account as a separate place to ringfence money.

Terms and Conditions apply, including applicants being resident in the UK & aged 18+ and, if relevant, businesses being based in the UK.

For full website terms including information on Zempler Bank, Mastercard and use of trademarks, please see our full legal disclosures at https://www.zemplerbank.com/legal/. Zempler Bank Limited (“Zempler Bank”) is registered in England and Wales at Cottons Centre, Cottons Lane, London SE1 2QG (No.04947027). Zempler Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under Firm Reference Number 671140.

Zempler Bank provides credit facilities subject to approval and affordability, and where accounts continue to meet Zempler Bank credit criteria.